This article has been authored by Nitin Jain, Partner, Agama Law Associates.

The role of an independent director is a prestigious one, but it carries significant responsibilities and attracts increasing scrutiny, especially in the financially difficult context of company insolvencies. Independent directors are expected to provide impartial guidance, safeguarding the interests of stakeholders. However, as companies teeter on the brink of financial distress, independent directors find themselves in a precarious position, facing potential liability for decisions made or oversight failures.

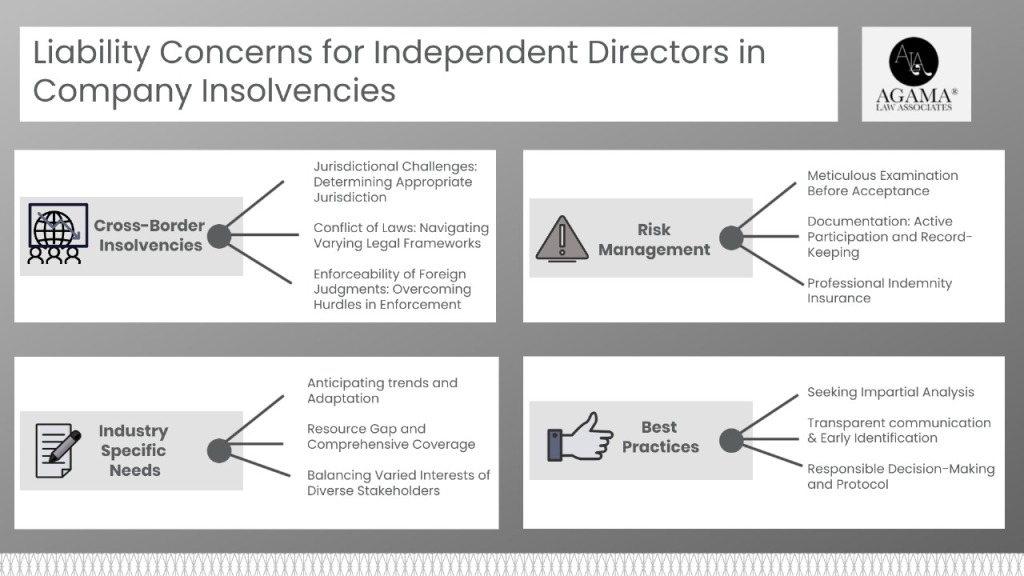

This article examines the challenges confronting independent directors during company insolvencies. We’ll explore risk mitigation strategies, delve into regulatory complexities, and discuss adapting legal approaches for diverse industry professionals.

Cross-Border Disputes and Strategies

For independent directors on the boards of companies with international operations, navigating insolvency becomes even more complex. Here’s a deep dive into the challenges and strategies to consider:

Jurisdictional challenges:

The first hurdle involves determining the appropriate jurisdiction for insolvency proceedings. This depends on factors like the company’s incorporation, the location of its principal assets, and the presence of creditors in various countries. International treaties like the UNCITRAL Model Law on Cross-Border Insolvency can provide guidance but may not always offer definitive answers.

Conflict of Laws:

Different countries have varying laws governing insolvency procedures, director duties, and standards of care. These conflicting laws can create a “conflict of laws” scenario, making it challenging to determine which legal framework applies to the specific situation. Engaging legal counsel with expertise in international insolvency law is crucial to navigate this complexity.

Enforceability of Foreign Judgments:

Even after a judgment is reached in one jurisdiction, enforcing it in another country can be a hurdle. International agreements like the Hague Convention on Judgments in Civil and Commercial Matters can simplify enforcement, but not all countries are signatories.

Strategies for Mitigating Cross-Border Disputes

Clear Contractual Arrangements:

Ensure watertight contractual clauses addressing dispute resolution and choice of law in all international agreements the company enters into. This provides greater clarity and predictability in case of insolvency.

Forum Selection Clauses:

Include forum selection clauses in contracts, specifying the preferred jurisdiction for resolving disputes related to the agreement. This can help streamline the process and avoid jurisdictional battles.

By understanding these complexities and adopting appropriate strategies, independent directors involved in multinational companies can better navigate the challenges of cross-border insolvency situations.

Risk Management Strategies

Independent directors can significantly reduce their exposure to potential liability in insolvency situations through careful planning and consistent action. Here’s a more detailed look at strategies to protect yourself:

Due Diligence: The Bedrock of Protection

Before accepting a board position, meticulously examine the company’s financial records, audited statements, outstanding liabilities, and contractual obligations. Look for warning signs of financial distress.

Maintain an ongoing, inquisitive attitude about the company’s operations. Directors shouldn’t be passive recipients of information; ask probing questions, and seek clarification where needed.

Documentation: Your Defense in Disputes

Participate actively in all board meetings, and ensure accurate minutes are recorded.

Make sure dissenting opinions or reasoned concerns you raised are carefully documented. This establishes your active engagement and thought process.

Maintain organized personal records for all relevant communications, reports, or consultations related to your role. Having a strong paper trail is key in potential disputes

Professional Indemnity Insurance: An Essential Safety Net

Evaluate the scope of your existing Directors and Officers (D&O) liability insurance, ensuring it’s tailored to the company’s profile and your specific needs. This is crucial when a company is navigating financial headwinds.

Understand the coverage limits, exclusions, and any specific provisions that might apply during insolvency proceedings.

Independent Advice: Navigating Uncertain Waters

Don’t shy away from seeking independent legal and financial advisory services, especially in complex insolvency situations or when there’s even a whiff of doubt.

A qualified professional can provide impartial analysis, offer alternative courses of action, and assess the risks and benefits of various decisions.

Proactive Communication: Transparency and Early Warning

If financial difficulties arise, encourage open communication between the board and company management. Early identification of problems increases the chances of finding viable solutions.

Promote a culture where directors can voice concerns without fear of retribution, creating a system for early flagging of potential risks.

Resignation: When it’s the Responsible Option

If you believe the company is heading towards insolvency and your concerns are repeatedly ignored, resignation might be the most prudent route to protect yourself.

Document your reasons extensively, including attempts to rectify the issues. Consult your legal counsel to ensure proper resignation protocols are followed.

Business Regulatory Advisory

The Indian regulatory framework governing company insolvencies is complex, evolving with legislative changes like the Insolvency and Bankruptcy Code, 2016 (IBC).

Some key points for independent directors to be aware of:-

Section 149(12) Companies Act 2013: Provides some protection to independent directors regarding liabilities for company omissions or commissions but requires proof of diligent action for its benefits.

Wrongful Trading: IBC regulations hold directors accountable for actions leading to worsening a company’s financial position before insolvency.

Staying up-to-date with regulatory developments is crucial for independent directors to exercise their duties responsibly and protect themselves from unforeseen liability.

Adapting to the Needs of Industry Professionals

The legal challenges faced by independent directors can vary significantly depending on the specific industry sector. Understanding the unique risks and regulatory dynamics of each industry is essential for advising effectively and protecting yourself from liability. Let’s examine how this applies in a few different contexts:

Highly Regulated Sectors: Industries like financial services, pharmaceuticals, or infrastructure typically face complex regulatory landscapes. Independent directors in these sectors require a deeper understanding of sector-specific laws, regulations, and compliance requirements. Failing to keep up-to-date can lead to costly missteps.

Industries Facing Disruption:1 Rapidly evolving industries fueled by technology or changing consumer demands create a challenging landscape for independent directors. It becomes crucial to stay ahead of the curve, anticipate potential disruptions, and advise the board on how to adapt or even pivot company strategy.

SMEs vs. Large Corporations: The resource gap between SMEs (Small and Medium Enterprises) and large corporations can significantly impact the role of independent directors.

In SMEs, independent directors might assume more direct responsibility and take on operational roles due to limited in-house expertise. This brings added risks and the need for more comprehensive insurance coverage.

Large corporations often have comprehensive in-house legal teams and established processes for director oversight. However, the increased exposure to regulatory scrutiny and potential reputational damage still calls for careful navigation.

Addressing Diverse Stakeholders: Different industries have unique sets of stakeholders with diverse priorities. Independent directors need to balance the interests of shareholders, creditors, employees, customers, regulators, and the wider community affected by the company’s actions. This often involves navigating scenarios with competing considerations.

Serving as an independent director requires diligence, proactive risk management, and a strong grasp of the evolving regulatory landscape. In the financially turbulent times of company insolvency, the potential liabilities faced by independent directors gain an extra edge. By understanding their duties, staying informed, and seeking expert guidance when needed, independent directors can navigate these complexities while fulfilling their responsibilities effectively.

Leave a comment